Mastering Swing Trading in Forex: A Comprehensive Guide

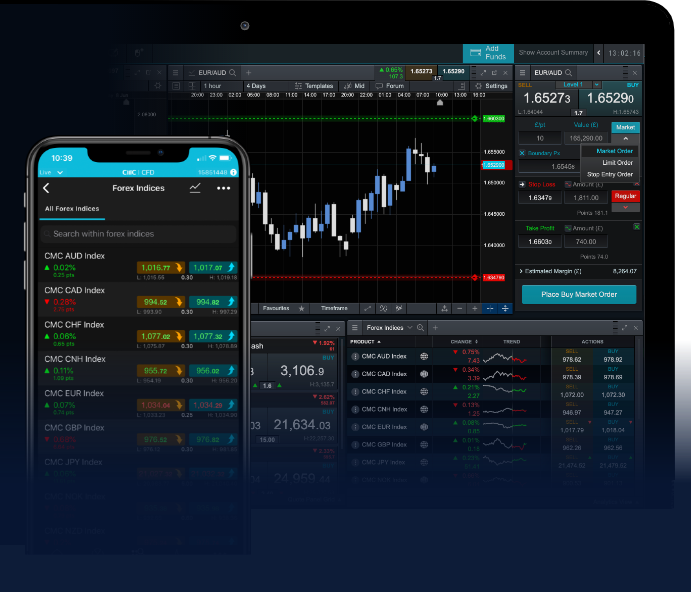

Swing trading in the Forex market is a popular strategy for both novice and experienced traders. It focuses on taking advantage of price swings over a few days to several weeks. The goal is to capture short- to medium-term trends in currency pairs, and swing trading forex LATAM Trading Platform can be an essential tool for executing trades successfully. In this article, we will delve deep into the world of swing trading, exploring its strategies, essential indicators, and best practices.

What is Swing Trading?

Swing trading is a method that involves capturing price movements or ‘swings’ in the foreign exchange market. Unlike day traders who close their positions within a single trading day, swing traders hold their positions for several days or weeks. This approach allows traders to benefit from both technical and fundamental analysis, identifying potential entry and exit points over a more extended period.

The Psychology Behind Swing Trading

Successful swing trading also requires a strong understanding of market psychology. Traders must remain disciplined and avoid emotional decision-making, which can lead to costly errors. It’s crucial to develop a trading plan that includes not only entry and exit strategies but also risk management techniques to protect capital.

Key Characteristics of Swing Traders

- Patience: Swing trading demands patience, as traders often need to wait for the right opportunities.

- Flexibility: Adapting to market changes and new information is essential.

- Risk Management: Successful traders always incorporate risk management strategies.

Strategies for Swing Trading

There are several strategies that traders can employ when engaging in swing trading. Here are a few popular methods:

1. Moving Average Crossovers

Moving average (MA) crossovers are a simple yet effective strategy for identifying price trends. Traders can utilize short-term MAs (e.g., 5-day or 10-day) and long-term MAs (e.g., 50-day or 200-day) to spot potential buy or sell signals.

2. Fibonacci Retracement

The Fibonacci retracement tool helps traders identify potential reversal levels. By plotting Fibonacci levels on a price chart, swing traders can find areas of support and resistance, allowing for more informed entry and exit points.

3. Candlestick Patterns

Understanding candlestick patterns can significantly enhance a trader’s ability to predict market movements. Patterns such as engulfing, doji, and hammer can indicate potential market reversals or continuations.

Essential Technical Indicators for Swing Trading

To enhance trading decisions, swing traders often rely on various technical indicators. Here are some of the most useful ones:

1. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. Values above 70 usually indicate overbought conditions, while values below 30 indicate oversold conditions, providing traders with potential buy or sell signals.

2. Moving Average Convergence Divergence (MACD)

The MACD is another popular indicator that shows the relationship between two moving averages. It helps traders identify potential buy and sell signals based on crossovers and divergences.

3. Average True Range (ATR)

The ATR measures market volatility, which is crucial for swing traders when determining entry and exit points. A higher ATR indicates more volatility, which can mean larger price swings, presenting more trading opportunities.

Risk Management in Swing Trading

One of the critical aspects of successful swing trading is effective risk management. Here are some strategies to consider:

1. Position Sizing

Determine the size of your trade based on your account balance and risk tolerance. Many traders follow the 1% rule, which suggests risking no more than 1% of your trading capital on a single trade.

2. Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses. By setting a stop-loss order at a predetermined level, you can protect your capital from significant downturns in the market.

3. Take-Profit Strategies

Establish clear take-profit levels based on your analysis. Whether you use fixed targets or trailing stops, knowing when to take profits is essential for long-term success.

Building a Swing Trading Plan

A well-defined trading plan serves as a roadmap for your swing trading endeavors. Your plan should cover the following aspects:

- Trading goals and objectives

- Market analysis techniques

- Entry and exit criteria

- Risk management strategies

- Review and evaluation process

Common Mistakes to Avoid in Swing Trading

Many traders fall into common pitfalls that can adversely affect their success. Here are some mistakes to avoid:

1. Overtrading

It’s easy to become overzealous in the market, but overtrading can deplete your resources quickly. Stick to your trading plan and only trade when opportunities align with your strategy.

2. Ignoring Market News

Economic events and news releases can significantly influence currency prices. Staying informed and understanding how market news can impact your trades is vital.

3. Lack of Discipline

Trading based on emotions can lead to drastic mistakes. Always adhere to your trading plan and maintain discipline in your trading activities.

Conclusion

Swing trading in Forex is a technique that allows traders to capitalize on market movements over several days or weeks. By understanding market psychology, employing effective strategies, and implementing risk management practices, traders can improve their chances of success. Whether you are just starting or looking to refine your skills, mastering swing trading techniques can help you become a proficient Forex trader. Remember always to use a reliable trading platform like the LATAM Trading Platform to execute your trades and stay updated with market trends.