Chance administration try a serious aspect of quantitative exchange, making sure traders can be browse business volatility and manage their assets. Key strategies for risk management were diversification, condition measurements, plus the use of end-losings orders. Value-at-exposure (VaR) data are utilized in order to guess prospective losings in the a financial investment profile, delivering investors having a decimal measure of chance. Backtesting is the process of collecting monetary study and you can comparing they to help you historic study establishes to determine if your method succeeded or not. Exposure management is the process of having fun with statistical models and statistics to identify you are able to economic dangers. Typically, quantitative trade was much more about impactful around the world from financing.

Which have efforts, practice, and continuing discovering, you might go on a profitable travel on the fascinating community of quant change. In the late 1990s, Long-Label Financing Government—work with by Nobel-effective economists and you may experienced Wall surface Highway traders—displayed both energy and you can problems of extremely leveraged quant steps. LTCM’s crisis within the 1998 underscored exactly how coordinated investments you’ll unravel quickly in the an urgent situation, almost toppling around the world areas. While it discolored the newest quants’ character briefly, LTCM and forced the so you can fortify risk administration and circumstances assessment. Transfers first started offering electronic rates feeds, spurring the fresh line of intraday presses—cost troves proper trying to test algorithms on the actual historical analysis.

- Compliance relates to keeping accurate facts, revealing deals appropriately, and you can ensuring that exchange actions don’t break any regulatory criteria.

- Quantitative exchange, during the their key, spends analytical models and analytical study and then make change behavior.

- Actually a tiny error regarding the underlying layout to your part of the quant trader can lead to a huge exchange loss.

- But not, 1st initiatives during the “formulaic” paying were often standard, impeded by the limited investigation and computational power.

- The purpose of quant exchange should be to create repeated quick winnings in the market and to do it constantly.

Feel and you may Qualifications

To own smaller than average medium-sized organizations (SMEs) looking to finest understand economic segments if you don’t discuss advanced funding options, discovering a guide to quant change is even more important. This article stops working just what quant change is actually, the newest procedures behind it, and you may exactly what the future keeps. By eliminating the newest emotional ability away from trade, quantitative procedures offer a quantity of accuracy and you can feel you to person traders do not suits. Moreover, the capacity to become familiar with huge amounts of research and you can perform investments from the high rate lets quant investors to exploit opportunities you to definitely might possibly be undetectable so you can conventional buyers. Quantitative analysts, also called “quants,” gamble a vital role in the determining effective investments and development rates actions within the this really is. They normally use mathematical actions and you may statistical app to research financial investigation, determine money risks, and you may improve profiles.

Decimal Trading Tips (Laws and regulations, Settings, And you can Backtests )

A broker – Get acquainted with a number of brokers in addition to their membership, margin, and change regulations. As well as, look out for any APIs they may provides and you can what is needed to accessibility her or him. Roentgen – Unlock source program coding language exactly like Python, a real workhorse to have analysis control and you can investigation. Bringing always the next systems, application, and methods can assist make you an excellent headstart on your quant travel. Along with the coding above, maintaining the new process and you will technologies is even a vital role away from an excellent quant.

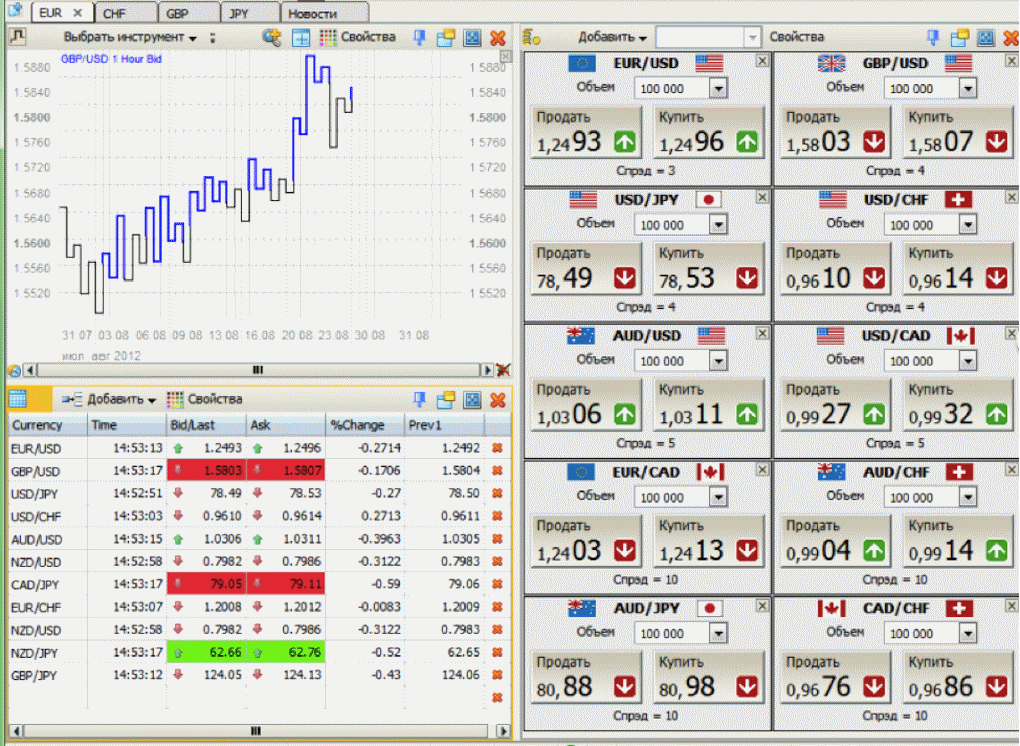

![]()

People references in order to prior efficiency, historic production https://orlenwislaplock.com/ , upcoming projections, and you may statistical predicts are no make sure away from future output otherwise upcoming efficiency. Plus500 will not be held responsible the explore that can be produced of the suggestions and for one consequences which can come from for example have fun with. Which, anyone pretending based on this article does therefore from the the individual discernment. Every piece of information has not been wishing in accordance with judge requirements designed to render the brand new liberty away from money look. Inside a quickly altering field landscape, additional exchange elements and functions are now being brought in the a rate which can look dizzying occasionally. One designs are quantitative change, and you may understanding how it truly does work is vital to putting on an extensive grasp today’s change land.

It offers leverage to help you change of several tips and you may diversify more than some other possessions, day frames, and you will field recommendations. One of the most important things in the trade should be to trade of a lot assets, each other business recommendations, and other time structures. Be it anxiety or avarice, when exchange, feeling provides simply to stifle rational thinking, which causes losings. Computers and you will mathematics don’t provides ideas, therefore decimal trading eliminates this issue.

If you are a trading robot is also work on individually, people oversight remains required. For many who’d such as an expert profession while the a quant individual, your talent usually order a paid out of economic companies. The fresh execution shortfall means will reduce the costs sustained while in the the newest delivery out of trades, enhancing the entire efficiency of your own exchange process.

Prior to buying or attempting to sell an option that have Composer Securities LLC, delight read the “Characteristics and you will Risks of Standard Options,” also known as the options Revelation Document (ODD). Choices purchases are often state-of-the-art and will expose buyers in order to potentially fast and ample losings. Sometimes, you can even get rid of all of your funding within the a somewhat short time.

The usage of mathematical habits such as the Black-Scholes try an excellent testament to your strength out of decimal analysis inside the changing traditional trade procedures. The effectiveness of quant exchange actions is dependant on their ability so you can process and you may get acquainted with huge amounts of data fast and you may correctly. Automated trade solutions ensure it is quant people to do trades based on predefined criteria, keeping texture and you will accuracy within their items.

Overfitting during the design development is an additional risk, where a product works well for the historic study but fails in the real-globe requirements. Regulating scrutiny adds difficulty, particularly in section such as higher-volume trading. High-frequency exchange (HFT), a good subset of algorithmic exchange, are described as large rate and quick carrying attacks. HFT businesses exploit quick rates discrepancies round the places or exchanges, labeled as latency arbitrage. This calls for tall funding within the tech, and co-location services to reduce latency.

The new medical approach developed by the Jim Simons also provides beneficial understanding and procedure which can alter exactly how we exchange and you may spend money on economic areas. Coding languages including C++ and you will Python are generally utilized together with her within the quantitative trading options to possess its respective benefits. Python is more in check to own fund advantages entering programming, so it is a greatest alternatives inside quantitative change. C++, together with other coding dialects, is frequently employed by algorithmic traders simply because of its performance and you may results. Even with their benefits, HFT along with presents dangers, such as improved industry volatility and you may prospective software glitches. HFT firms must browse these types of demands to maintain success and you may regulating compliance.

Meanwhile, the newest tips of the latest ages manage really with high-risk locations, and also the growth of public trade allows newbies to duplicate quant trade possibilities and trade for example elite traders. LiteFinance now offers a duplicate exchange system where you could engage inside the societal exchange. The one thing I ought to alert your in the is that you shouldn’t risk over you really can afford to get rid of. Zero profits of even an expert quantitative individual in the past promises a confident improve future. The main tip is the fact that speed have a tendency to productivity so you can its average beliefs (on the simplest version, he or she is computed using a relocation mediocre), which is exactly what the quant trading technique is centered on. Technical research, basic research, or a combination of one another are often used to make an enthusiastic algorithmic trading strategy.

Early incarnations put co-discover machine and you can lead business usage of competition for microseconds away from advantage. This is an organic extension of quant reason, although it started brutal discussions in the fairness and market design. Lyle Daly try a contributing Motley Deceive stock-exchange specialist covering information technology and you will cryptocurrency.